What is Fraud?

Fraud entails deliberate and secretive action to obtain an illegal advantage. To minimize the risk of fraud, first and foremost you need to assess the risks and possible consequences. Any measures are always focused on limiting the opportunity and detecting the crime as soon as possible.

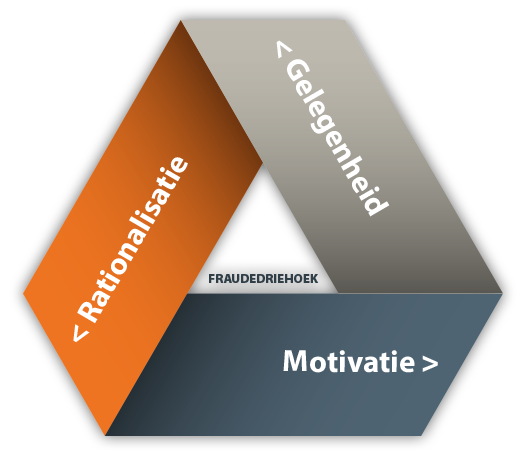

Fraud Triangle

Fraud can occur in relation to money, goods, time and information. The damage to the party harmed can be large and cannot always be expressed in monetary terms, for example, where damage to reputation is involved. In serious cases the very existence of the business can even be put in danger.

Research shows that there are three factors that play an important part in the emergence of fraud. These are the three elements from the Fraud Triangle:

- Opportunity: Experience shows that it is precisely those employees in positions/functions with a large amount of knowledge of procedures, the organisation and existing fraud supervision checks which actively look for opportunities to commit fraud.

- Motive: A perpetrator has a certain motive, like poverty/need for money, to commit fraud.

- Rationalization: The fraud thinks his crime is justifiable. For example: “I work hard enough for it”, or “The company makes plenty of profit anyway”.

In order to conceal the fraud, the perpetrator will usually follow a carefully devised and complicated plan.

Forms of Fraud

Rudimentary, we can distinguish three forms of fraud:

Fraud Prevention

In order to minimise the risk of fraud, it is important that businesses recognise the possibility of fraud occurring and the possible damage caused. In order to do this, a good starting point is a “quick scan” or an R&CSA (Risk & Control Self Assessment). Both are resources which can be used to identify, measure, monitor and mitigate risks. Risks and likely consequences are made explicit from an early stage. Due to the intensive participation of managers and colleagues in the process, an R&CSA will, in particular, lead to results which will have broad support.

The measures, bespoke or otherwise, which organisations can take to prevent fraud are always aimed at limiting opportunities and reducing the time it takes to discover fraud. In addition, every measure aimed at limiting fraud is related to one or more of the elements of the fraud triangle.

Ask our specialists

Would you like to know more about our services? Or what we can mean for your organization? Please, feel free to contact one of our specialists.

Harold de Kruijs

Managing Consultant

Call Harold directly: +31 (0) 26 479 22 28